Centers for Medicare and Medicaid Services (CMS) released the Medicare Part A Skilled Nursing Facility (SNF) Prospective Payment System (PPS) FY2023 Proposed Rule containing the components that will go into effect 10/1/22 pending any changes made based on comments and feedback over the next few months.

The Proposed Rule contains all the “usual,” with updates to Part A rates, ICD-10 code mapping for PDPM, SNF Quality Reporting Program (SNF QRP) changes, and SNF Value Based Purchasing (SNF VBP) updates, as well as a glimpse into potential changes in the Quality Measure programs down the road.

Of particular interest to the SNF therapy and MDS professional is the proposed solution to the major topic in last year’s rule “Recalibrating the PDPM Parity Adjustment.” Last year, CMS shared provider practice patterns that occurred during the first year after transition from the RUG-IV payment system to the Patient Driven Payment Model (PDPM), that caused a 5% overpayment to SNFs, resulting in a necessary “recalibration” that would decrease each PDPM daily component rate significantly.

If you need a refresh on that, this resource will help: CMS Release of PDPM Therapy Data

In this article, let’s take a quick look at the highlights that are most pertinent to SNF therapy and MDS professionals. There is quite a bit to digest here…

Medicare Part A Payment Rate Changes

The Federal Per Diem rates are updated annually. On 10/1/22 the rates for Part A have a proposed increase of 3.9%, which at first glance, seems to be a jump up from last year’s 1.3%. However, because this rate will then be “recalibrated” to balance out the PDPM overpayments by an additional 4.6% reduction (parity adjustment) the overall rate change for FY2023 is – 0.7%. This equates to approximately $320 million less in payments to SNFs for the year.

The detail: [(Market Basket % increase of 2.8% + Forecast Error Correction of 1.5%) – 0.4% Multi-factor Productivity Adjustment (MFP)] = 3.9%, further reduced by 4.6% “recalibration,” for a – 0.7% outcome.

In the Rule, CMS proposes a few options for implementing the recalibration, including a delayed and/or phased in approach, vs the 4.6% decrease all at once. Comments will be considered and the Final Rule will determine the method used.

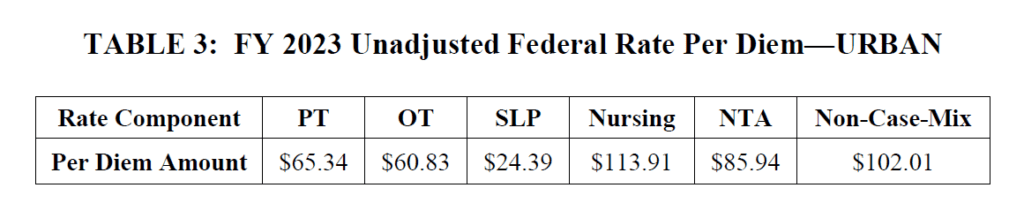

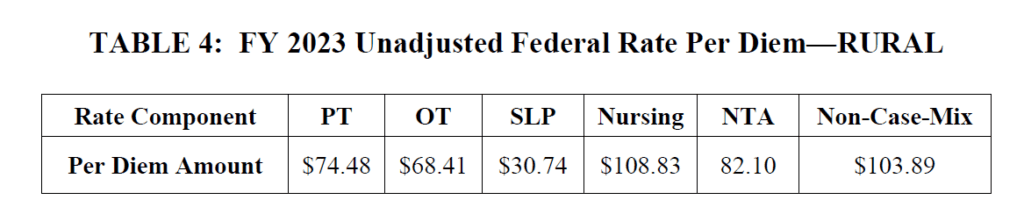

Below are the proposed unadjusted rates that when multiplied by the case mix index values, determine each PDPM Case Mix Group rate.

If you compare these rates with last year’s, you will see that the per diem amounts for most components went up. So how does this equate to an overall 0.7% decrease in payments? The case mix index values that are multiplied by these rates decreased. More on that next…

Medicare Part A PDPM Changes – Case Mix Index Values

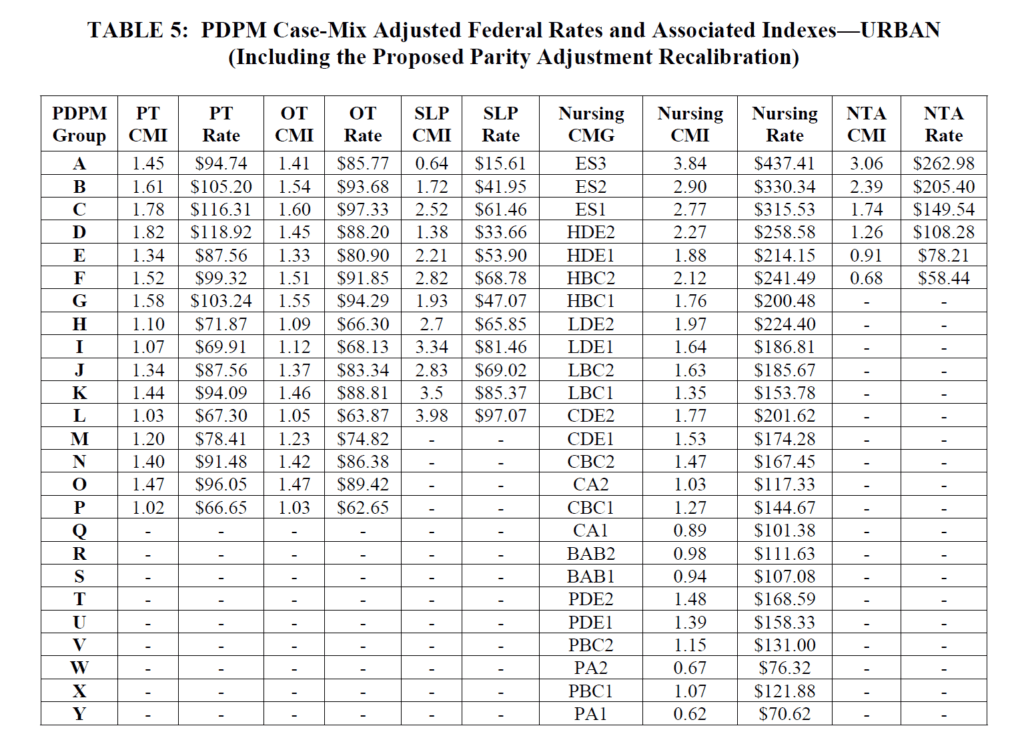

Case Mix Index values for each of the PDPM Components, PT, OT, Speech, Nursing and Non-Therapy Ancillary, show significant reductions for FY2023. When multiplied by the Unadjusted Federal Per Diem Rates shown above, Case Mix Group rates will look something like this for FY2023 (Urban).

The reduction in the case mix index values is how the “PDPM recalibration” is accomplished, producing overall lower Medicare Part A daily rate payments per stay.

How does this look in a real life example?

A resident is admitted for rehab after a total knee replacement, with a comorbidity of morbid obesity, staying for a total of 20 days, with a HIPPS code of CAPE on the 5-Day PPS Minimum Data Set (MDS) assessment:

- FY2022 Pays $715.65 per day for days 1-3, $557.01 for days 4-20 = Total for 20 days = $11,616.12

- FY2023 Proposed $710.56 per day for days 1-3, $554.14 for days 4-10 = Total 20 days = $11,552.06

A difference of $64 less for the 20-day stay in FY2023 vs FY2022.

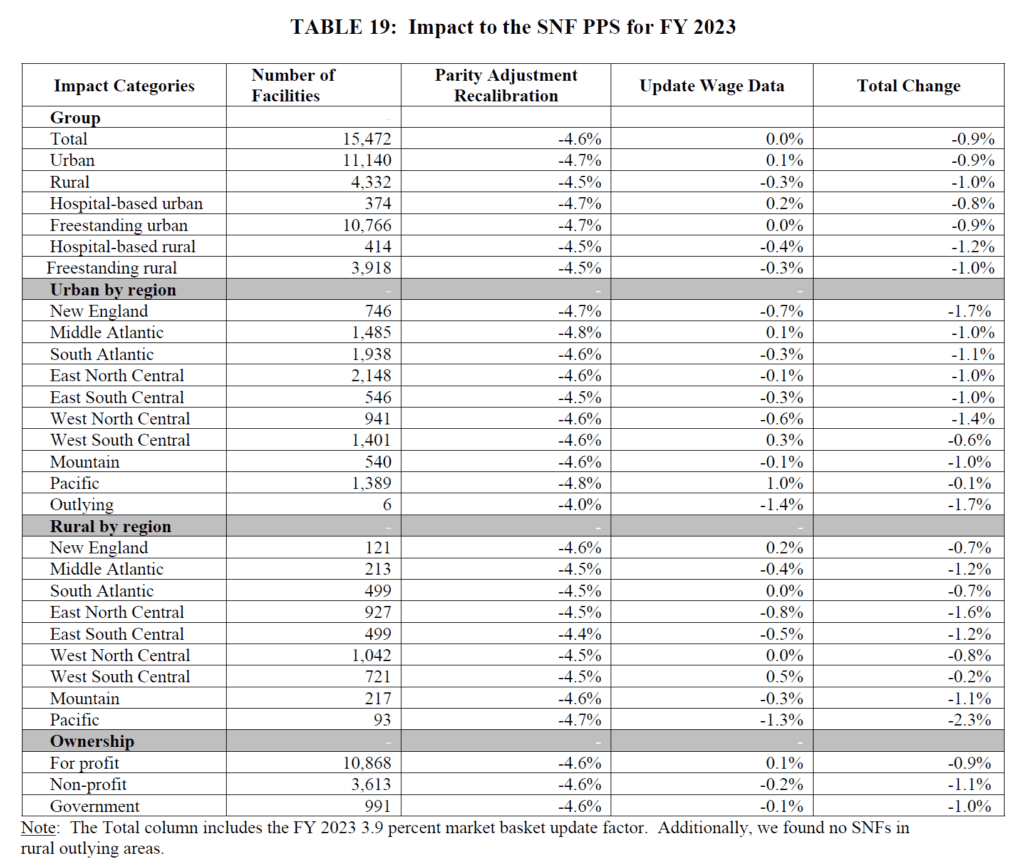

CMS provides the impact summary for FY2023 rate changes only. See where your SNF fits into the picture.

Medicare Part A PDPM Changes – ICD-10 Code Mapping for PT, OT and Speech Components

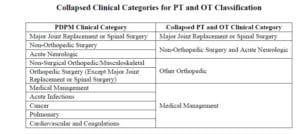

ICD-10 Codes used in MDS Section I0020B as the primary reason for SNF Part A covered care are used for case mix classification under PDPM. Using the Mapping Tool provided by CMS, each ICD-10 Code can be mapped to 1 of 4 PT and OT Clinical Categories as shown here, or identified as a Return to Provider code [meaning this code cannot be used in Section I0020B of the MDS].

Proposed ICD-10 Mapping changes for FY2023 are as follows:

- D75.839 “Thrombocytosis, unspecified,” currently mapped to “Cardiovascular and Coagulations” will be changed to “Return to Provider.”

- D89.44, “Hereditary alpha tryptasemia” currently mapped to “Medical Management” will be changed to “Return to Provider.”

- F32.A, “Depression, unspecified” currently mapped to “Medical Management” will be changed to “Return to Provider.”

- G92.9, “Unspecified toxic encephalopathy” currently mapped to “Acute Neurologic” will be changed to “Return to Provider.”

- M54.50, “Low back pain, unspecified” currently mapped to “Non-surgical Orthopedic/Musculoskeletal” will be change to “Return to Provider.”

- The following codes, now “Return to Provider,” will be mapped to “Medical Management:”

- K22.11, “Ulcer of esophagus with bleeding;”

- K25.0, “Acute gastric ulcer with hemorrhage;”

- K25.1, “Acute gastric ulcer with perforation;”

- K25.2, “Acute gastric ulcer with both hemorrhage and perforation;”

- K26.0, “Acute duodenal ulcer with hemorrhage;”

- K26.1, “Acute duodenal ulcer with perforation;”

- K26.2, “Acute duodenal ulcer with both hemorrhage and perforation;”

- K27.0 “Acute peptic ulcer, site unspecified with hemorrhage;”

- K27.1, “Acute peptic ulcer, site unspecified with perforation;”

- K27.2, “Acute peptic ulcer, site unspecified with both hemorrhage and perforation;”

- K28.0, “Acute gastrojejunal ulcer with hemorrhage;”

- K28.1, “Acute gastrojejunal ulcer with perforation;”

- K28.2, “Acute gastrojejunal ulcer with both hemorrhage and perforation;” and

- K29.01, “Acute gastritis with bleeding.”

Changes In Wage Index – Geographical Locations – For Medicare Part A Calculation

Providers are deemed “urban” or “rural” for purposes of calculating the labor portion of the daily rate, a factor in determining the overall daily rate for a facility. Using wage index values specific to location to adjust the labor portion of the rate is done to reflect the wage differences throughout the country.

Reimbursement rates are different depending on where you live.

The updated Wage Index Tables for FY 2023 can be found below.

Not sure if you are urban or rural? Use the Wage Index Look Up Tool HERE

Changes to CMS Medicare Part A Quality Programs

SNF Quality Reporting Program (SNF QRP)

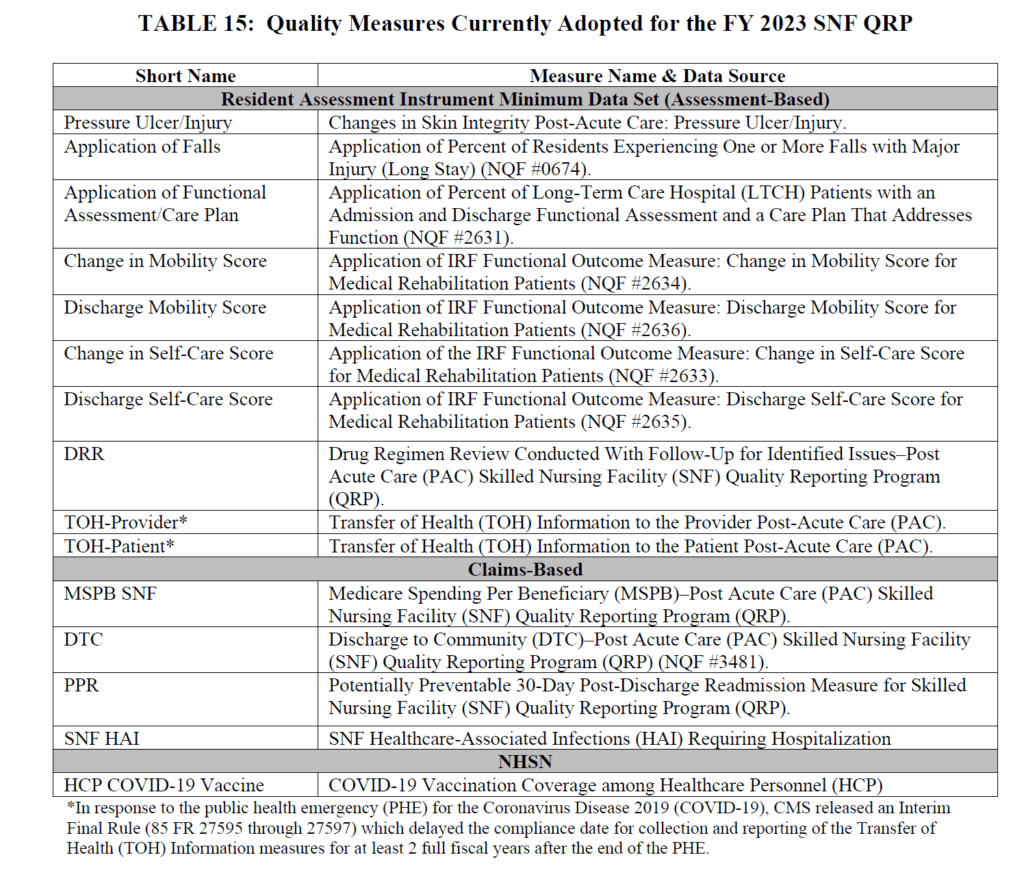

- The SNF QRP is the program behind Section GG, as well as other MDS data collection to measure multiple areas of care. This program has been around for over 6 years, and data collection for the multiple measures in this program will continue.

- This is a pay for reporting program, meaning, SNFs are required to report measure data, and if not reported, facilities will continue to be subject to a 2% Part A payment penalty. The penalty occurs for missing information, not for the data outcome.

- What does missing data look like? MDS questions that have missing (dashed) data in select items.

- Here are the Measures in place for FY2023:

The last 2 measures above were discussed in detail in last year’s Final Rule and HERE, with a quick recap below:

- SNF Healthcare-Associated Infections Requiring Hospitalization measure (SNF HAI): This outcome measure collects data for infections acquired in the SNF resulting in re-hospitalization.

- COVID-19 Vaccination Coverage among Healthcare Personnel (HCP): This process measure tracks COVID-19 vaccination coverage among HCP in the SNF setting and publishes rates on Care Compare for the public

New SNF QRP Measures on the Horizon for 10/1/24:

- Influenza Vaccination Coverage Among Healthcare Personnel

- Data collection will begin 10/1/22 and end 3/31/23 (flu season)

- Submitted via CDC’s National Healthcare Safety Network (NHSN)

- Includes separate calculations for employees, non-employed licensed independent practitioners (ie: MD), students and volunteers, and contract staff.

- Results will be publicly reported on Care Compare

- 2% Part A rate penalty for not reporting

- Transfer of Health Information (Provider and Patient) Measures

- These 2 MDS measures above have been on hold while awaiting changes to the MDS

- Data collection will start 10/1/23….which means we will have a BIG MDS update soon

- Standardized Patient Assessment Data Elements (SPADES)

- CMS adopted SPADES for the following categories collected on the MDS:

- Cognitive function and mental status

- Special services, treatments, and interventions (e.g., need for ventilator, dialysis, chemotherapy, and total parenteral nutrition)

- Medical conditions and comorbidities (e.g., diabetes, heart failure, and pressure ulcers)

- Impairments (e.g., incontinence; impaired ability to hear, see, or swallow)

- Data collection will start 10/1/23 on selected SPADES

- Link to Measure information

- CMS adopted SPADES for the following categories collected on the MDS:

What do all these changes mean? As the list of measures continues to grow, there is a greater chance of missing information and incurring a 2% payment penalty.

Starting 10/1/22, not only do 80% of MDS assessments need to contain 100% of the SNF QRP required data, SNFs also need to submit 100% of data for the COVID-19 and Influenza Vaccination for Healthcare Personnel to the CDC NHSN system.

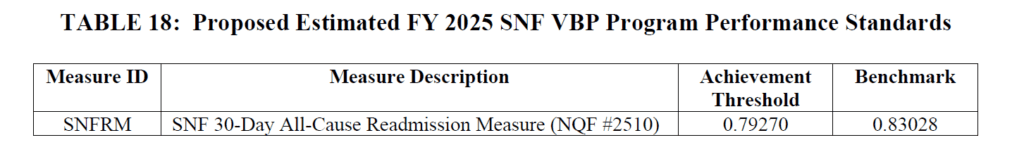

SNF Value-Based Purchasing Program (SNF VBP)

- The SNF VBP Program is the one that reduces Medicare Part A payments to all SNFs by 2% and then allows for an opportunity to recoup all or part of the 2% by demonstrating success with the established Quality Measure, SNF 30-Day-All-Cause Readmission Measure. In essence, this measures if the resident was readmitted back to the hospital within 30 days of being discharged from the hospital. (“SNF Potentially Preventable Readmissions after Hospital Discharge Measure”)

- The proposed rule includes reductions in the VBP estimated at $185 million in payments to SNFs for FY2023.

- Will continue to suppress the use of the readmission measure data for scoring and payment purposes for FY2023 due to the PHE. This will include withholding the 2% required every year, followed by a 1.2% pay-back to SNFs (0.8% reduction for all). Plans to resume in FY2024.

- Achievement Threshold and Benchmark data for FY2025 as pictured here, though no significant changes were made to the program for FY2023 that will impact SNF therapy.

- Proposing to adopt 2 new measures for FY2026:

- SNF HAI Requiring Hospitalization

- Total Nursing Hours per Resident Day Staffing (Total Nurse Staffing) Measure

- Proposing 1 new measure for FY2027:

- Discharge to Community – Post Acute Care

- CMS is also requesting input in multiple areas for future VBP rule-making consideration, including:

- Staff turnover

- Including the NHSN COVID-19 Vaccination Coverage among Healthcare Personnel Measure

- Updating the SNF VBP Exchange Function for translating scores into payments

- Validating SNF Measures and Assessment Data

- Approach to Measuring and Improving Health Equity

Other Areas Covered in the Rule

CMS is using the Proposed Rule as an opportunity to request input from providers. This Request for Information is in 2 major areas:

- Infection Isolation

- CMS is seeking comments regarding resources used for caring for residents in isolation when alone in a room, vs with a roommate with the same condition. Currently, coding for isolation in Section O on the MDS does not qualify unless a resident is alone in the room, and when coded, produces one of the highest Nursing Case Mix Groups, as well as 1 Non-Therapy Ancillary Point, under PDPM. Comments may possibly impact how isolation is coded and paid for in the future.

- Revising Requirements for LTC Facilities to Establish Mandatory Minimum Staffing Levels

- CMS states “we are considering policy options for future rulemaking to establish specific minimum direct care staffing standards and are seeking stakeholder input to inform our policy decisions.”

What’s Next?

We have new rules to digest and cuts to prepare for, all while keeping in step with the temporary Public Health Emergency (PHE) rules. Multiple waivers are still in place though some are starting to be phased out, with a new PHE expiration date of July 15th.

CMS is accepting comments for the proposed rule through June 10, 2022. We know from past results that comments submitted have the potential to influence CMS decisions. Consider commenting on an area you are passionate about. You never know! Electronic comments can be made at https://www.regulations.gov Follow the “Submit a comment” instructions.

Additional Resources:

HERE is a link to the Proposed Rule.

HERE is a link to the CMS Fact Sheet.

PDPM Calculators and Resources HERE

If you have any questions, send them to our Just Ask Q&A Forum and we will reach out to you to get your questions answered.

Thank you for all you are doing to provide the best care to the geriatric population!

In your corner,

Dolores

Dolores Montero, PT, DPT, RAC-CT, RAC-CTA